10

Supplementary reports

Review of Subsidiaries

People’s Insurance PLC

Vision

To be appreciated for building lasting trust based on strength, stability and sustainability.

Mission

We will work with all our stakeholders with integrity and fairness, maintain high standards in sales and servicing, respect creativity and commitment of our staff and offer sound insurance solutions to our clients for a sustainable future.

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

| People’s Insurance PLC (PI) | 22 July 2009 | January 2010 | Registered as a non-life insurance provider under the Regulation of Insurance Act | One of Sri Lanka’s most profitable non-life insurers with constant underwriting profits since 2012 |

Ownership structure

People’s Insurance is 75% owned by People's Leasing which is 75% owned by People’s Bank.

Products

|

Lifestyle Products designed to help families prepare for the unexpected and reduce the financial burden in times of loss, including – |

||

|

|

|

|

Business products that target commercial operators and corporates, including – |

||

|

|

|

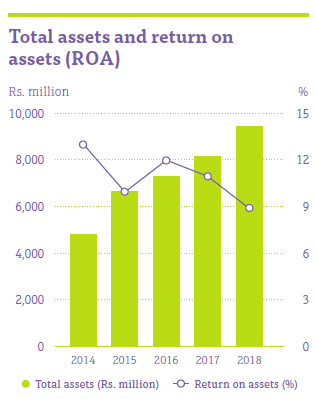

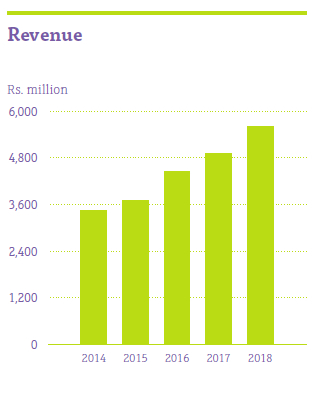

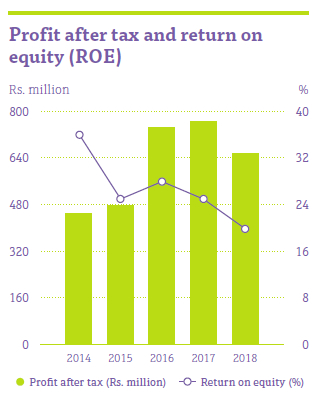

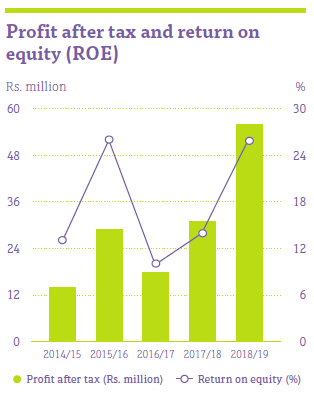

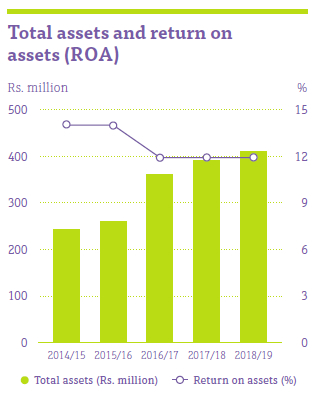

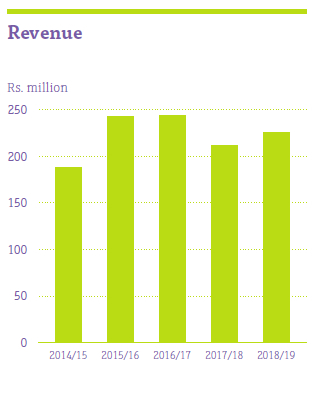

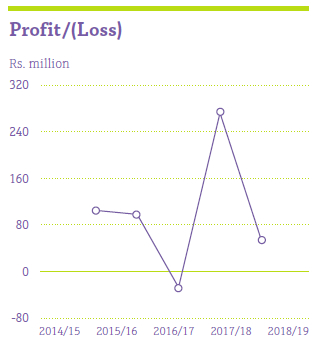

Financial highlights

| Strategic Priorities for the year (2018) | Key activities during the year (2018) | Strategic Priorities for the year (2019) | ||

| Achieve balanced top-line growth by increasing business volumes |

Opened two new regional offices at Kandy and Kurunegala |

Achieve balanced top-line growth by increasing business volumes | ||

| Leverage on the cost-effective distribution channel and expand our outreach in strategic locations | Established two new window offices at People’s Leasing branches | Leverage on the cost-effective distribution channel and expand our outreach in strategic locations | ||

| Ensure equal opportunity and fair employment to attract and retain best talent; extend training to hone employee skills; and inculcate professionalism | Direct business earnings from regional offices accounted for 4% share | Ensure equal opportunity and fair employment to attract and retain best talent; extend training to hone employee skills; and inculcate professionalism | ||

| Uphold professionalism and ensure efficiency to extend best-in-class customer service and experience | Recruited 96 new marketing representatives | Uphold professionalism and ensure efficiency to extend best-in-class customer service and experience | ||

| Build brand equity by positioning the organisation in relation to the competitive and market environment |

Invested Rs. 7 million in branding and marketing initiatives, taking up 2% share of the marketing and administration costs |

Build brand equity by positioning the organisation | ||

|

Strengthen internal controls, risk management and conform with laws, rules and regulations stipulated by relevant regulators and other statutory bodies |

First ever TV commercial won a merit certificate from Sumathi Tele awards 2018 | Strengthen internal controls, risk management and conform with laws, rules and regulations stipulated by relevant regulators and other statutory bodies | ||

| Closely engage communities and initiate community service projects and philanthropic activities | Invested approximately Rs. 1 million on community-based projects | Closely engage communities and initiate community service projects and philanthropic activities |

People’s Micro-commerce Ltd.

Vision

To improve sustainable livelihoods of the community and be the most sought-after microfinance company in

Sri Lanka.

Mission

To economically empower low income earners and micro entrepreneurs by providing inclusive finance in a sustainable ethical and profitable manner.

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

|

People’s Micro-commerce Ltd. (PML) formally known as People’s Microfinance Ltd. |

3 September 2010 | March 2011 |

Providing microfinance facilities to underprivileged, rural, and urban population of Sri Lanka |

One of the key microfinance institutions in the country with past eight years of operation |

Ownership structure

People’s Microfinance is 100% owned by People’s Leasing which is 75% owned by People’s Bank.

Products

|

Individual Business Loans – For families who are economically active and specially engaged in small business, and who are able to find new income sources and/or to expand their existing income sources, including – |

||

|

|

|

|

Asset-based Loans (Hire purchase and equipment facilities) – providing microfinance facilities to the underprivileged, rural, and urban populations with asset-backed facilities for SME client base including: |

|

|

|

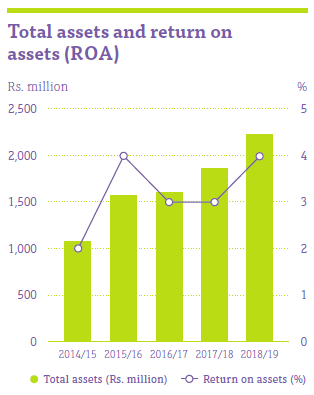

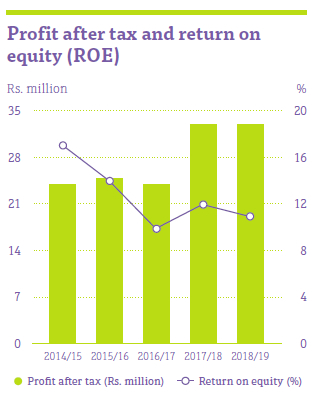

Financial highlights

| Strategic Priorities for the year (2018/19) | Key activities during the year (2018/19) | Strategic priorities for the year (2019/20) | ||

|

Expedite credit and support services to face stiff market competition through effective delegation |

Introduced branch grading system and set up incentive scheme accordingly to motivate the staff |

Establish a PML stand-alone branch | ||

| Strengthen recovery steps together with strong monitoring of customer portfolio |

Introduced bar code system to PML vault to streamline the vault process |

Establish separate tender department for PML | ||

| Identifying, retaining, and motivating the existing talent by creating new opportunities |

All the Certificate of Registration of Motor Vehicle of credit facilities scanned and included in the Microcommerce system to improve customer service |

Strengthen recovery steps with the assistance of the IT Development by introducing SMS quick response inquiry facility for field officers | ||

| Continuous business growth by maintaining optimal product mix | Special training programmes were conducted for heads of PML |

Introduce Diriya Loan product for existing customer base |

||

| Create means for greater employee participation in decision-making | Streamline the PML legal recovery procedures to expedite the legal cases and discontinue portfolio recoveries |

People’s Leasing Fleet Management Limited

Vision

Be the fleet solution provider to the future of mobility.

Mission

To be the most admired purpose driven eco-friendly service provider, embracing breakthrough business ideas towards digitalisation domain.

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

| People’s Leasing Fleet Management Limited (PLFML) | 6 August 2008 | August 2008 | Vehicle fleet management, vehicle valuations, rent-a-car service, and – operating leases activities |

A registered fleet management company in Sri Lanka |

Ownership structure

People’s Leasing Fleet Management is 100% owned by People’s Leasing which is 75% owned by People’s Bank.

Products

|

Vehicle fleet services – |

||

|

|

|

|

Vehicle valuations |

||

|

|

|

Financial highlights

| Strategic priorities for the year (2018/19) | Key activities during the year (2018/19) | Strategic priorities for the year (2019/20) | ||

| Expand island-wide coverage of valuation unit and motor claim assessment | Expansion and streamlining of operational procedure of Valuation and Motor claim assessment unit | Strategic operational changes in fleet workshop operation | ||

| Obtain Carbon-Neutral Certificate |

Development and expansion of Rent-A-Car Unit |

Rs. 37.25 million for investment on rent-a-car operation |

||

| Payment of dividends of Rs. 2.6 million | Payment of dividends of Rs. 30 million | |||

| Initiate and conduct first programme of Fleet Management Challenge Trophy among People’s Leasing branch network |

People’s Leasing Property Development Limited

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

| People’s Leasing Property Development Limited (PLPDL) | 15 August 2008 | August 2011 | Property development and renting. The Company mainly engages in the implementation of projects and monitoring of construction of branches for People’s Bank | Property development |

Ownership structure

People’s Leasing Property Development is 100% owned by People’s Leasing which is 75% owned by People’s Bank.

Products

|

Products and services relating to property development including – |

|

|

|

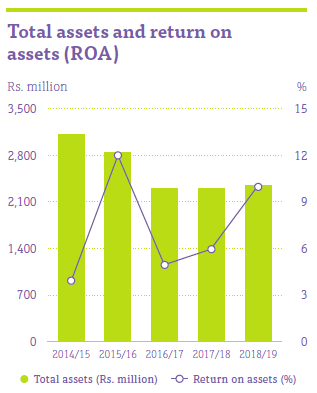

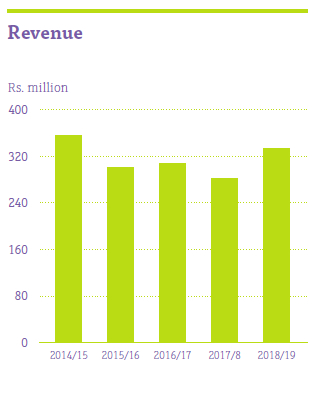

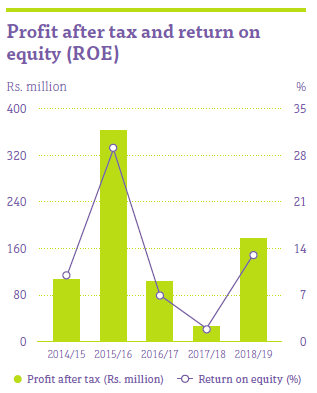

Financial highlights

| Strategic priorities for the year (2018/19) | Key activities during the year (2018/19) | Strategic priorities for the year (2019/20) | ||

| Complete majority of construction work related to two construction projects undertaken by the Company |

Completed and handedover one construction project of People's Bank |

Complete and handover ongoing construction projects of People's Bank | ||

|

Initiate the preliminary work of the proposed three projects |

Negotiating with the contractors to initiate the three construction projects of People's Bank |

Initiating the construction of new projects of People's Bank |

||

| Strengthen the financial position of the Company |

People’s Leasing Havelock Properties Limited

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

| People’s Leasing Havelock Properties Limited (PLHPL) | 12 August 2010 | June 2017 | Constructing and operating the office complex | Construction and property |

Ownership structure

People’s Leasing Havelock Properties is 100% owned by People’s Leasing which is 75% owned by People’s Bank.

Products

|

Products and services relating to property development including – |

||

|

|

|

Financial highlights

Lankan Alliance Finance Limited

Vision

To be the most innovative, dependable and customer-friendly financial institution in the country.

Mission

Maximise values for all stakeholders through uniqueness, dexterity and sustainable business practices. Ensuring superior and solution driven financing for our customers. Inculcate a culture of meritocracy in the ethos/philosophy of the company. Establish a principled and compliant organisation which adheres to the best corporate governance practices.

| Name of company | Date of incorporation | Date of commencement | Main business | Industry | ||||

|

Lankan Alliance Finance Limited (LAF) |

13 December 2017 | December 2017 | Providing leasing of movable and immovable properties and loans | Operates as a non-banking financial institution in Bangladesh |

Ownership structure

Lankan Alliance Finance is 51% owned by People’s Leasing which is 75% owned by People’s Bank.

Products

|

Lending products including – |

|

|

|

Financial highlights

Net profit after tax

Rs. 67.98 million

Total Assets

Rs. 3.82 billion

Total deposits

Rs. 1.01 billion

Shareholders’ Equity

Rs. 2.38 billion

| Strategic priorities for the year (2018) | Key activities during the year (2018) | Strategic priorities for the year (2019) | ||

| Focused on Corporate Clients which have good ratings and financial strength | Evaluation of corporates in the market, system vendors, People’s Leasing system readiness with Lankan Alliance Finance Limited | SME roll-over | ||

| Development in information system | Market research on SME loan products and further development | Increase the operation on Lease Finance | ||

| Further development of SME loan products | Recruitment of best-suited talent and professional development | Introduce factoring operation | ||

| Further development of leasing product | Apply a seamless information system | |||

| Involvement of increasing capital market activities |